Introduction:

In today's ever-changing global supply chain environment, material planners in the cable and wire (C&W) industry face a myriad of challenges unique to their sector. The complexity of these challenges demands not only operational expertise but also strategic foresight to navigate effectively. This blog aims to delve into the intricate obstacles encountered by material planners amidst supply chain disruptions and offers a comprehensive approach to optimize material planning processes tailored specifically to the cable and wire industry. We will explore strategies to enhance visibility, drive sustainable value creation, and incorporate Business Process Model and Notation (BPMN) to streamline operations.

Understanding the Complex Challenges:

1. Inventory Management Dilemma:

Material planners are grappling with the delicate balance between excess and insufficient inventory levels, both of which come with significant financial implications, particularly when key NF metals (Copper and Aluminum) constitutes close to 70% of the cable costs.

Excessive inventory ties up huge working capital and warehouse space, while inadequate inventory disrupts production schedules and compromises customer satisfaction.

2. Navigating Raw Material Costs:

The cable and wire industry faces relentless fluctuations in raw material costs, compounded by supply shortages and market volatility. Procurement strategies must be agile to handle spot purchases and the volatile prices of petroleum-based products, which are essential components in cable and wire production.

3. Quality Assurance and Consistency:

Ensuring consistent raw material quality from suppliers is paramount to product integrity and customer satisfaction. However, fluctuations in quality standards and supply disruptions can lead to severe production delays and rework, amplifying operational costs and sometimes resulting in liquidity damages.

4. Lead Time Uncertainty:

Suppliers' lead times often exhibit high variability in the cable and wire industry, making accurate material availability predictions challenging. Unpredictable lead times can disrupt supply chain synchronization and increase the risk of stockouts or overstocking, adversely affecting production schedules and customer commitments.

5. Geographical and Logistics Constraints:

Specialized raw materials used in the cable and wire industry may come from geographically dispersed suppliers, introducing logistical complexities and potential delivery delays. Material planners must navigate these constraints while ensuring timely procurement and minimizing transportation costs, which are critical considerations in this sector.

6. Obsolete Inventory Management:

Managing slow-moving and obsolete inventory is a perennial challenge, requiring proactive inventory control measures and disposition strategies. Obsolete inventory ties up valuable capital and warehouse space, eroding profitability and operational efficiency.

Special Polymeric materials used in W&C business typically have a limited Shelf life Expiry Date (SLED), after which the performance of the raw material may deteriorate, leading to poor quality of cable, electrical failures and poor processability of the material itself.

Some special raw materials used in W&C industry like Mica Tapes, Silicon Rubber and critical ingredients used in compounding of PVC, Low Smoke Zero Halogen (LSZH), Rubber and Fluropolymers require temperature controlled storage in the warehouse. In such cases, the storage capacity over-rides all fundamentals of Inventory modelling, as excess stock can lead to faster deterioration and obselence.

7. Demand Forecasting Conundrum:

Accurate demand forecasting is foundational to effective material planning, yet it remains elusive amidst market uncertainties and fluctuating customer demands. Material planners must leverage historical data to cover the base requirements of demand, and fine tune their inventory models through market insights, and collaborative forecasting techniques to enhance forecast accuracy.

8. High-Performance Cable Certifying Bodies:

Some internationally recognized cable performance certifying bodies require that the cable be manufactured only using pre-approved raw materials from pre-approved suppliers like in case of fire resistance and nuclear cables. This further adds complexity to the material planning matrix and dilemma of the planners.

Other challenges include

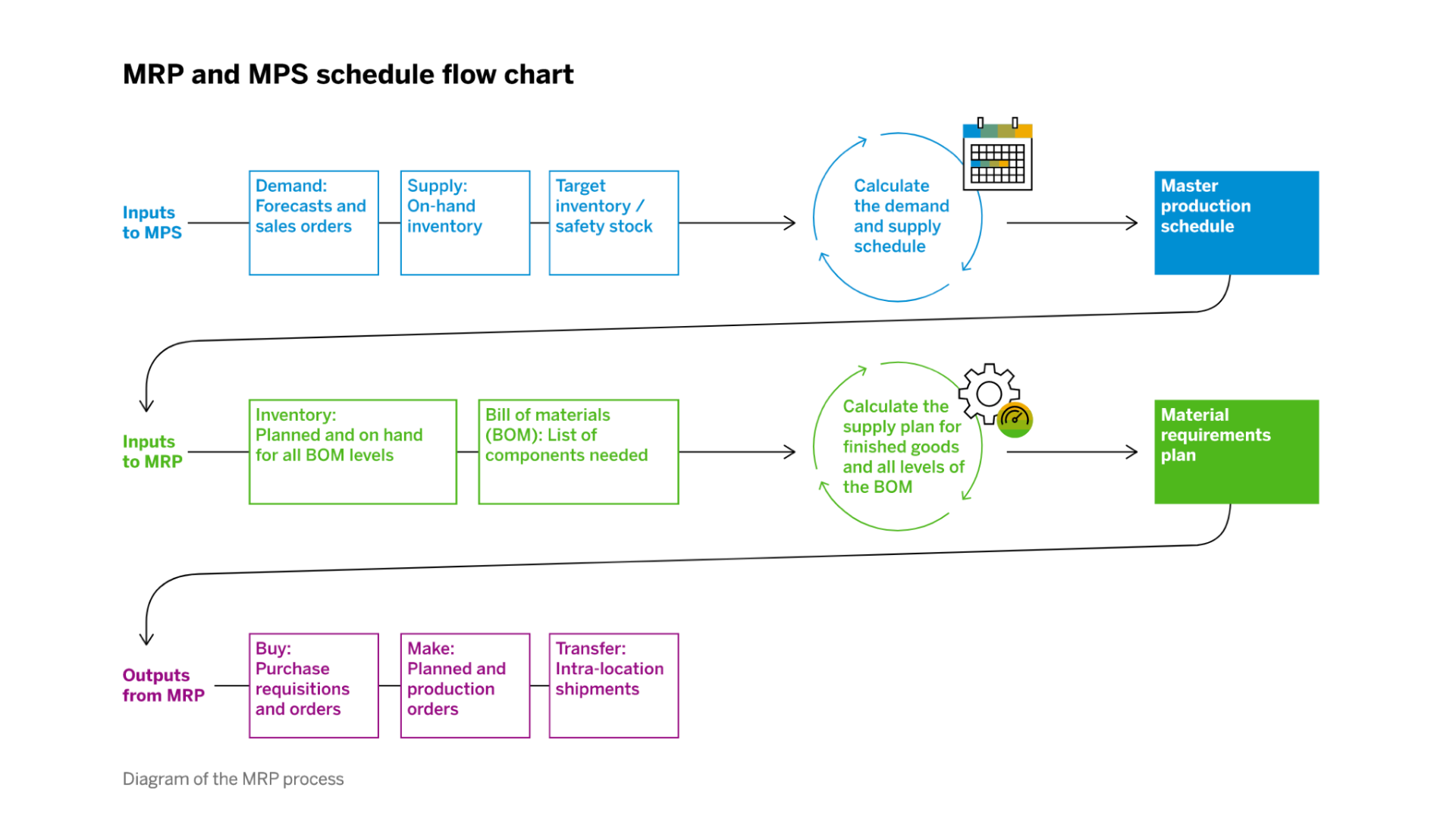

Data Quality: MRP relies heavily on accurate data. If the data used in the MRP system is not accurate, the entire process can be compromised.

Training: Staff must be trained on how to use the MRP system effectively. This can be a significant investment in time and resources.

Envisioning Success: Expected Outputs and Business KPIs:

1. Financial Optimization:

Aligned inventory working capital with budgetary plans to optimize financial resources and reduce carrying costs. Achieve a balance between inventory levels and working capital, minimizing excess inventory while ensuring adequate stock levels to meet demand.

2. Operational Excellence:

Maintain a service level of material availability for production exceeding 95%, reducing the risk of production disruptions and customer dissatisfaction. Implement tighter controls over high-value raw materials to prevent stockouts, minimize lead time variability, and optimize production schedules.

3. Strategic Procurement:

Streamlining procurement processes ensures timely delivery of raw materials, mitigates supply chain risks, and optimizes procurement costs specific to the cable and wire industry.

4. Enhanced Visibility and Forecast Accuracy:

Improve visibility into forward sales demand and supply chain dynamics, enabling proactive decision-making and responsive inventory management. Enhance demand forecast accuracy through data analytics, collaborative forecasting, and market intelligence, reducing forecast errors and improving inventory turnover.

.

Strategies for Success:

1. Integrated Planning and Collaboration:

Foster cross-functional collaboration between material planning, production, procurement, and sales teams to synchronize demand forecasts, production schedules, and inventory levels. Implement integrated planning processes and real-time communication channels to facilitate proactive decision-making and rapid response to changing market conditions.

2. Data-Driven Insights and Predictive Analytics:

Harness the power of data analytics, machine learning, and predictive modeling to analyze historical consumption patterns, identify demand trends, and predict future requirements. Utilize advanced forecasting techniques and predictive analytics to anticipate changes in demand, optimize inventory levels, and reduce lead time variability.

3. Supplier Relationship Management:

Develop strategic partnerships with key suppliers to gain visibility into their capabilities, capacity constraints, and market insights. Collaborate with suppliers to optimize inventory levels, streamline procurement processes, and mitigate supply chain risks through joint planning and demand forecasting initiatives.

Gen AI for Procurement is new buzz phrase. In order to enable this process, the inputs from “Material Planning” has to be with a high level of accuracy, which in turns necessitates data driven models.

4. Continuous Improvement and Innovation:

Foster a culture of continuous improvement and innovation within the organization, encouraging cross-functional collaboration, knowledge sharing, and process optimization. Invest in employee training and development programs to enhance skills, foster innovation, and drive operational excellence across the material planning function.

.

Incorporating BPMN Model:

- Utilize BPMN to map out material planning processes, identify bottlenecks, and streamline operations.

- Model end-to-end material planning workflows, including demand forecasting, procurement, inventory management, and production scheduling.

- Identify key decision points, process dependencies, and performance metrics to drive process improvement initiatives.

- Leverage BPMN diagrams to visualize process flows, facilitate communication across cross-functional teams, and drive alignment towards common objectives.

Anticipated Business Impact:

1. Optimized Inventory Management:

Streamlined material planning processes and proactive inventory management will lead to optimized inventory levels and reduced carrying costs specific to the cable and wire industry.

2. Improved Operational Efficiency:

Enhanced visibility and tighter inventory controls will result in improved operational efficiency and enhanced customer satisfaction in the cable and wire industry.

3. Cost Savings and Value Creation:

Strategic procurement initiatives and collaborative supplier relationships will drive cost savings, risk mitigation, and value creation specific to the cable and wire industry.

4. Increase in OEE:

Adequate stock of right quality of raw materials at the right time fosters improvement in the availability, performance of the machines and good quality product. This in turns drives the OEE factor up. Statistics have shown that a 10% increase in the OEE can result in potential of ROCE by upto 3 percentage points

Conclusion:

In conclusion, material planners in the cable and wire industry must adopt a proactive and strategic approach to overcome the multifaceted challenges posed by the dynamic supply chain landscape. By leveraging data-driven insights, fostering collaboration, embracing innovation, and incorporating BPMN to streamline operations, organizations can optimize material planning processes and drive sustainable value creation. As we navigate the turbulent waters of the supply chain crisis, let us embark on this journey together, emerging stronger, more agile, and more resilient than ever before. Together, we can master material planning for the cable and wire industry and thrive in the face of uncertainty. .